Dublin, Feb. 05, 2021 (GLOBE NEWSWIRE) -- The 'Gambling Global Market Report 2021: COVID-19 Impact and Recovery to 2030' report has been added to ResearchAndMarkets.com's offering.

Gambling Global Market Report 2021: COVID-19 Impact and Recovery to 2030 provides the strategists, marketers and senior management with the critical information they need to assess the global gambling market as it emerges from the COVID-19 shut down.

Major companies in the gambling market include William Hill; MGM Resorts; Las Vegas Sands; Paddy Power and Betfair Entertainment.

The global gambling market is expected to grow from $465.76 billion in 2020 to $516.03 billion in 2021 at a compound annual growth rate (CAGR) of 10.8%. The growth is mainly due to the companies rearranging their operations and recovering from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges. The market is expected to reach $674.7 billion in 2025 at a CAGR of 7%.

The gambling market consists of sales of gambling services and related goods by entities (organizations, sole traders and partnerships) that operate gambling facilities, such as casinos, bingo halls, video gaming terminals, lotteries, and off-track sports betting. Gambling is the act of wagering money or something of value on an event with an uncertain outcome that is not under gambler control, with an intent of winning money.

Bingo parlors, coin-operated gambling device concession operators, bookmakers, lottery ticket sales agents, and card rooms are also included in this market. The gambling market also includes sales of gambling services and related goods by entities that operate casino hotels. The gambling market is segmented into casinos; lotteries; sports betting and other gambling.

Asia Pacific was the largest region in the global gambling market, accounting for 38% of the market in 2020. North America was the second largest region accounting for 29% of the global gambling market. Middle East was the smallest region in the global gambling market.

Branded slots are increasingly becoming popular in the gambling industry. Branded slots are licensed online casino games built around universally popular subjects such as movies, TV shows, music or books. Brand loyalty draws the customers towards trying slot games revolving around their favorite characters.

Branded online slot games attract casual bettors, even the ones with little experience and interest in slot machines, as they create a connection with the players due to their familiarity with characters on the slots, increasing the traffic on the slot machines. Branded slots based on Game of Thrones, Westworld, Batman, and Jurassic Park are some of the most popular branded slot games.

Coronavirus Pandemic: The outbreak of Coronavirus disease (COVID-19) has acted as a massive restraint on the gambling market in 2020 as governments globally imposed lockdowns and restricted domestic and international travel limiting the need for services offered by these establishments.

Changing Consumer Gambling Habits: The demand for gambling is expected to be driven by the changing gambling habits of consumers. The increasing popularity of gambling apps and social gambling will propel the growth of the market going forward. The global social casino market is expected to reach $4.64 billion by 2020, growing at a CAGR of 5%. The increasing adoption of mobile devices and increasing internet penetration will drive the demand for online gambling, driving market growth.

Key Topics Covered:

1. Executive Summary

2. Report Structure

3. Gambling Market Characteristics

3.1. Market Definition

3.2. Key Segmentations

4. Gambling Market Product Analysis

4.1. Leading Products/ Services

4.2. Key Features and Differentiators

4.3. Development Products

5. Gambling Market Supply Chain

5.1. Supply Chain

5.2. Distribution

5.3. End Customers

6. Gambling Market Customer Information

6.1. Customer Preferences

6.2. End Use Market Size and Growth

7. Gambling Market Trends and Strategies

8. Impact of COVID-19 on Gambling

9. Gambling Market Size and Growth

9.1. Market Size

9.2. Historic Market Growth, Value ($ Billion)

9.2.1. Drivers of the Market

9.2.2. Restraints on the Market

9.3. Forecast Market Growth, Value ($ Billion)

9.3.1. Drivers of the Market

9.3.2. Restraints on the Market

10. Gambling Market Regional Analysis

10.1. Global Gambling Market, 2020, by Region, Value ($ Billion)

10.2. Global Gambling Market, 2015-2020, 2020-2025F, 2030F, Historic and Forecast, by Region

10.3. Global Gambling Market, Growth and Market Share Comparison, by Region

11. Gambling Market Segmentation

11.1. Global Gambling Market, Segmentation by Type, Historic and Forecast, 2015-2020, 2020-2025F, 2030F, $ Billion

If you want to experience the thrill of casino slot machine games all in one place, Betfair has it all. You can play all of the latest and most popular online slots in the world right here at Betfair online casino, including slots from award-winning developers such as Blueprint and Red Tiger. Whether you're looking for the best payout slot games or the most innovative progressive jackpots. Smart betting Since we first launched in 2000, across all our platforms,the Exchange, Sportsbook and the various updates to our app, has always been about smart betting. And smart betting starts and ends with knowing how much to bet, and not letting betting be a harmful part of your life.

- Casino

- Lotteries

- Sports Betting

- Other Gambling

11.2. Global Gambling Market, Segmentation by Channel Type, Historic and Forecast, 2015-2020, 2020-2025F, 2030F, $ Billion

- Offline

- Online

- Virtual Reality(VR)

12. Gambling Market Metrics

12.1. Gambling Market Size, Percentage of GDP, 2015-2025, Global

12.2. Per Capita Average Gambling Market Expenditure, 2015-2025, Global

Companies Mentioned

- William Hill

- MGM Resorts

- Las Vegas Sands

- Paddy Power

- Betfair Entertainment

For more information about this report visit https://www.researchandmarkets.com/r/mg5c9t

Research and Markets also offers Custom Research services providing focused, comprehensive and tailored research.

Attempt to secure US footing fails

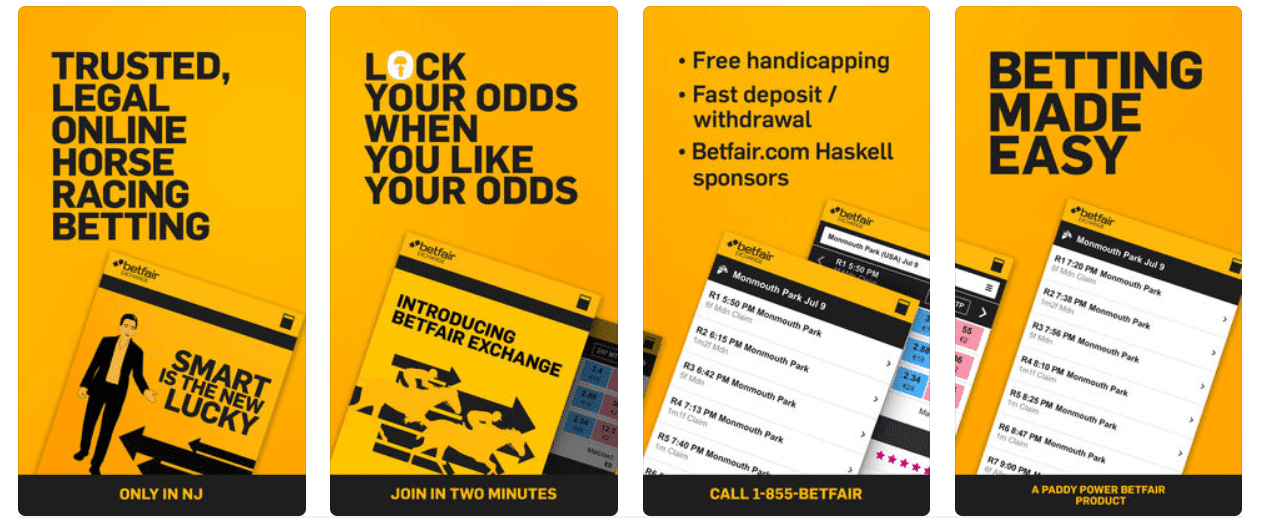

Leading UK gambling brand Betfair has announced it is withdrawing its race betting exchange from the New Jersey market. Betfair, which forms part of Flutter Entertainment along with brands like PokerStars, Paddy Power, and FanDuel, will no longer be offering the service starting October 1.

Kip Levin, chief operating officer of FanDuel Group – the owner of the Betfair Exchange in the US – said the exchange did not manage to reach the 'critical mass' necessary to make the operation profitable and efficient. While the Betfair betting exchange is very popular in the UK and other regions, it did not appeal to US customers, according to Levin.

customer base used to exotic wagers and a reluctance by major US racing associations'

Levin cited a number of reasons for the decision to withdraw from the NJ market, including 'a customer base used to exotic wagers and a reluctance by major US racing associations to embrace the different business model.' Specifically, Betfair failed to enter agreements with key players such as Churchill Downs, Del Mar, Keeneland, the Stronach Group, and NYRA to offer exchange betting for races at their racetracks.

Betfair Gambling Commission

Four-year lifetime

Betfair was licensed to operate in New Jersey in 2015 after getting approval from the New Jersey Division of Gaming Enforcement. It collaborated with Monmouth Park racecourse operator Darby Development to launch the US's first-ever race betting exchange in May 2016.

The brand also went on to offer its customers additional wagering options at other racetracks in the state. As well as the betting exchange, it has also been offering traditional fixed-odds race wagering through 4NJBets since 2016.

takeout structure may have compromised its business viability

According to Thoroughbred Daily News(TDN), the US betting exchange's takeout structure may have compromised its business viability. While Betfair was able to charge a low 5% commission in the UK as 'it was not required to turn over any of its profits to purses', its New Jersey customers were paying 12%. TDN cited the unavailability of legal exchange wagering in other states as another factor that prevented Betfair's US expansion.

Gambling Bet Calculator

Global restructuring

The announced market exit comes as part of a series of global restructuring efforts following the merger between Flutter Entertainment and The Stars Group, which was completed in May. With many gambling brands coming together under the same parent company, a process is in place to streamline operations across its business operations worldwide.

Pechanga. Flutter Entertainment recently said it would be withdrawing its PokerStars brand from Macau, Taiwan, and China. No specific reason was given for the decision.

If you want to experience the thrill of casino slot machine games all in one place, Betfair has it all. You can play all of the latest and most popular online slots in the world right here at Betfair online casino, including slots from award-winning developers such as Blueprint and Red Tiger. Whether you're looking for the best payout slot games or the most innovative progressive jackpots. Smart betting Since we first launched in 2000, across all our platforms,the Exchange, Sportsbook and the various updates to our app, has always been about smart betting. And smart betting starts and ends with knowing how much to bet, and not letting betting be a harmful part of your life.

- Casino

- Lotteries

- Sports Betting

- Other Gambling

11.2. Global Gambling Market, Segmentation by Channel Type, Historic and Forecast, 2015-2020, 2020-2025F, 2030F, $ Billion

- Offline

- Online

- Virtual Reality(VR)

12. Gambling Market Metrics

12.1. Gambling Market Size, Percentage of GDP, 2015-2025, Global

12.2. Per Capita Average Gambling Market Expenditure, 2015-2025, Global

Companies Mentioned

- William Hill

- MGM Resorts

- Las Vegas Sands

- Paddy Power

- Betfair Entertainment

For more information about this report visit https://www.researchandmarkets.com/r/mg5c9t

Research and Markets also offers Custom Research services providing focused, comprehensive and tailored research.

Attempt to secure US footing fails

Leading UK gambling brand Betfair has announced it is withdrawing its race betting exchange from the New Jersey market. Betfair, which forms part of Flutter Entertainment along with brands like PokerStars, Paddy Power, and FanDuel, will no longer be offering the service starting October 1.

Kip Levin, chief operating officer of FanDuel Group – the owner of the Betfair Exchange in the US – said the exchange did not manage to reach the 'critical mass' necessary to make the operation profitable and efficient. While the Betfair betting exchange is very popular in the UK and other regions, it did not appeal to US customers, according to Levin.

customer base used to exotic wagers and a reluctance by major US racing associations'

Levin cited a number of reasons for the decision to withdraw from the NJ market, including 'a customer base used to exotic wagers and a reluctance by major US racing associations to embrace the different business model.' Specifically, Betfair failed to enter agreements with key players such as Churchill Downs, Del Mar, Keeneland, the Stronach Group, and NYRA to offer exchange betting for races at their racetracks.

Betfair Gambling Commission

Four-year lifetime

Betfair was licensed to operate in New Jersey in 2015 after getting approval from the New Jersey Division of Gaming Enforcement. It collaborated with Monmouth Park racecourse operator Darby Development to launch the US's first-ever race betting exchange in May 2016.

The brand also went on to offer its customers additional wagering options at other racetracks in the state. As well as the betting exchange, it has also been offering traditional fixed-odds race wagering through 4NJBets since 2016.

takeout structure may have compromised its business viability

According to Thoroughbred Daily News(TDN), the US betting exchange's takeout structure may have compromised its business viability. While Betfair was able to charge a low 5% commission in the UK as 'it was not required to turn over any of its profits to purses', its New Jersey customers were paying 12%. TDN cited the unavailability of legal exchange wagering in other states as another factor that prevented Betfair's US expansion.

Gambling Bet Calculator

Global restructuring

The announced market exit comes as part of a series of global restructuring efforts following the merger between Flutter Entertainment and The Stars Group, which was completed in May. With many gambling brands coming together under the same parent company, a process is in place to streamline operations across its business operations worldwide.

Pechanga. Flutter Entertainment recently said it would be withdrawing its PokerStars brand from Macau, Taiwan, and China. No specific reason was given for the decision.

Betfair announced its decision to exit the Russian market in May as it did not have a local operating license. It withdrew its horse race betting operations from the Japan market the following month. The brand stepped away from the market in India in 2019, citing significant competition.

Exchange coming to NJ

While the soon-to-close Betfair betting exchange in New Jersey was only covering racing markets, a startup plans to operate a full sports betting exchange in the state under the Sporttrade brand.

Gambling Betfair Real Money

The platform will launch imminently through Sporttrade's partnership with Twin River Worldwide Holdings, the soon-to-be owner of Bally's Atlantic City Hotel and Casino. The Philadelphia-based startup claims it will be the first regulated sports betting exchange to launch in the United States. The operation is currently awaiting regulatory approval.